Ira withdrawal calculator

Find a Dedicated Financial Advisor Now. Revised life expectancy tables for 2022 PDF.

Download Traditional Ira Calculator Excel Template Exceldatapro

To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

. Get started by using our Schwab IRA calculators to help weigh your options and compare the different accounts available to you. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from. Calculate the required minimum distribution from an inherited IRA.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Find a Dedicated Financial Advisor Now. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

With our IRA calculators you can determine potential tax. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. This is a very.

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Keep in mind if your account is less than. It is mainly intended for use by US.

Ad Whats Your Required Minimum Distribution From Your Retirement Accounts. Since you took the withdrawal before you reached age 59 12 unless you met one. Use this calculator to determine your Required Minimum Distribution RMD.

Do Your Investments Align with Your Goals. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Money deposited in a traditional IRA is treated differently from money in a Roth. Do Your Investments Align with Your Goals. Starting the year you turn age 70-12.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe.

Ad Use This Calculator to Determine Your Required Minimum Distribution. If you have multiple IRAs you must calculate each account. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Traditional IRA Calculator Details To get the most benefit from this calculator you should use data that reflects your current financial situation. Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. If its not you will.

Account balance as of December 31 2021 7000000 Life expectancy factor. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Not an easy task.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. 6 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Retirement Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from. Automated Investing With Tax-Smart Withdrawals.

The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. With a Roth IRA your withdrawals are tax-free after you turn 59 ½. Ready To Turn Your Savings Into Income.

If you dont have that information. 0 Your life expectancy factor is taken from the IRS. The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum required withdrawal and then forecast your future required.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Savers over age 50 can contribute 7000 per year instead of the 6000 limit.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Ira Calculator Excel Template Exceldatapro

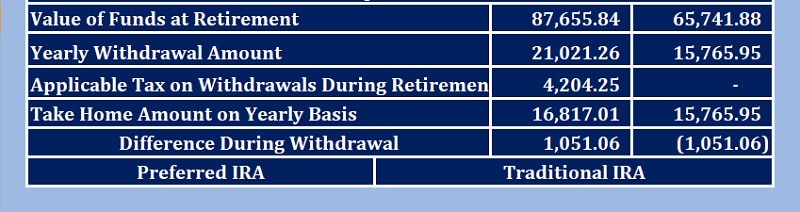

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Free Traditional Ira Calculator In Excel

Free 9 Sample Retirement Withdrawal Calculator Templates In Pdf

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Excel Template For Free

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Calculate Rmds Forbes Advisor

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Retirement Withdrawal Calculator For Excel

Okauyxe80u81 M

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

How Does An Ira Loan Work Smartasset Com

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks